Is Your Ecommerce Business Sales Tax Compliant?

Get a complimentary compliance assessment to ensure you’re calculating and filing sales tax with 100% accuracy.

Whether you sell in two states or 50, sales tax can be, well, taxing.

With TaxCloud it's simple:

- Instantly calculate sales tax rates

- Automatically collect sales tax at the time of transaction

- Get access to file-ready sales tax reports

- Self-file or let TaxCloud file and remit for you

- Rest assured sales tax rates are up to date

- Track nexus so you always know when and where you owe tax

- Support any time you need it

Let's get started.

What TaxCloud Does

Calculation & Collection

Instantly calculate and collect sales and use tax.

Filing & Remittance

Let us handle your tax filing, remittance, state registrations and exemptions.

Tax Reports

Create return-ready sales tax reports to support your filing needs.

Audit Support

Need support during an audit? Our team is here ready to help.

About TaxCloud

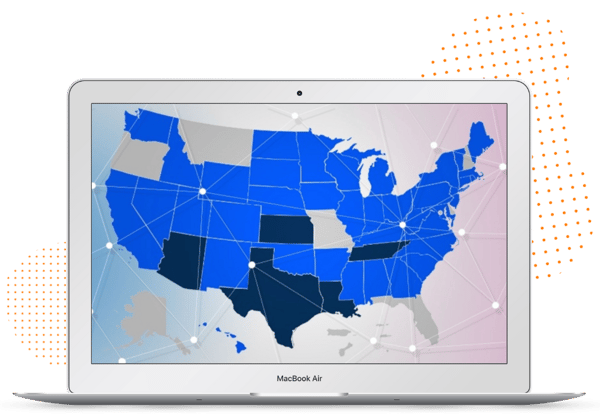

TaxCloud has been partnering with merchants in all 50 U.S. states since 2010. Combining the power of automation and a team of certified TaxGeeks, TaxCloud instantly calculates sales tax rates across the 13,000+ U.S. jurisdictions, collects sales tax at the moment of transaction, files with 100% accuracy, and helps you manage audits as they arise.